Thesis

This vault is suitable for depositors who want to earn yield in BTC, ETH, ARB, or AVAX from fees in the GMX GM trading pools, while believing that the price of these assets will trend downwards with high market volume.

Essentially, this vault is best if you believe:

→ BTC, ETH, ARB, or AVAX will continue in a downward trend. 🔻

→ Your selected GMX GM pools will continue to attract traders for earning fees. 🧲

→ The perp traders on your selected pools will continue to lose more than they gain. 🕗

Overview

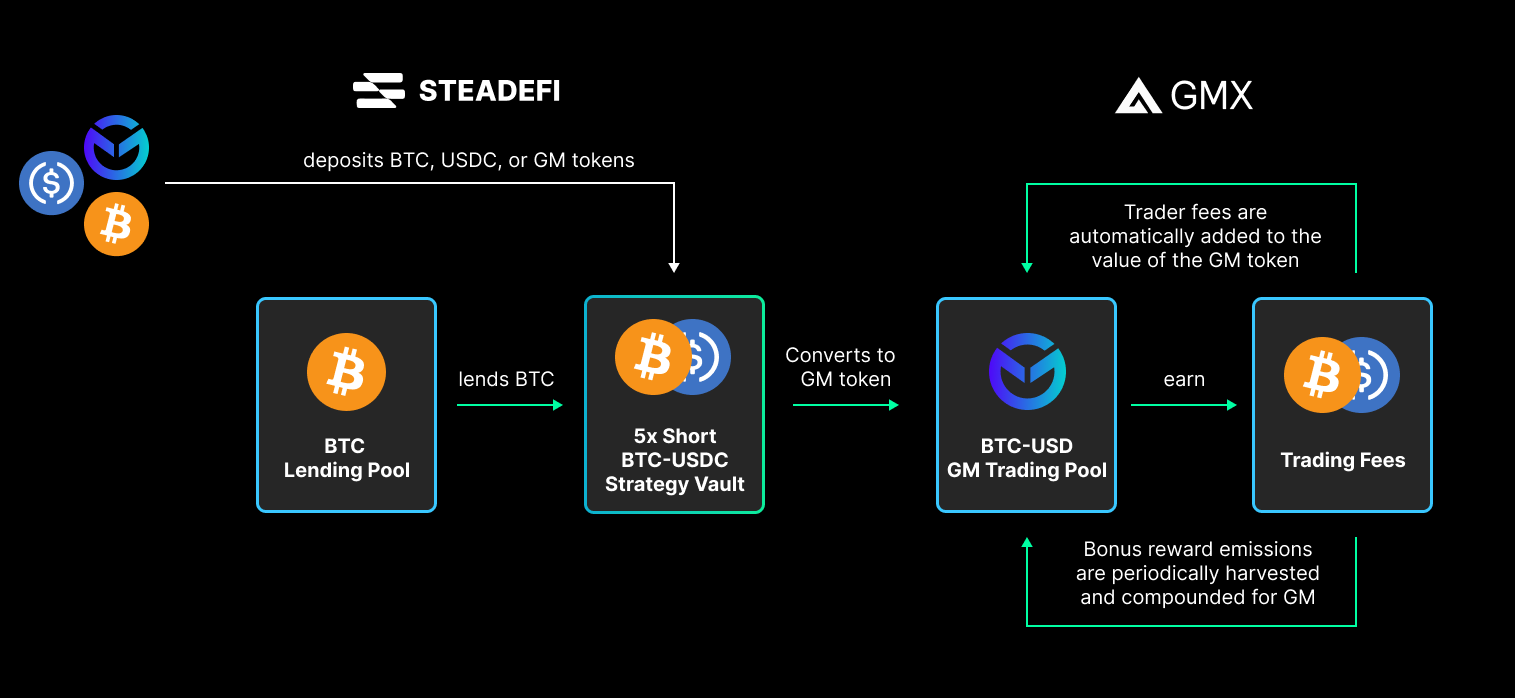

Using 5x leverage on deposits, this strategy earns more yields from the GM pool trading fees, while also having a hedge to the price of the volatile asset and the trader PnL.

Chains

Arbitrum

Implementation (BTC-USDC GM Pool example)

- Depositor deposits BTC, USDC, or GM token to the vault and receives svTokens

5S-BTCUSDC-GMX

- Vault borrows BTC so that the total value of assets are now 5x the value initially deposited

- Vault deposits all assets to mint GM tokens

- Keeper compounds additional rewards (if any) for more GM token

- Keepers check vault’s position status to determine if a rebalance is needed

- Depositor withdraws their position from the vault by burning svTokens

5S-BTCUSDC-GMXand receives BTC or GM tokens

Rebalance: a “reset” of the vault’s assets such that the debt ratio stays within a healthy range. In uptrending markets, this means the vault will increase leverage over time, and in downtrending markets, the vault will decrease leverage over time.

Risks

- GMX traders make consistent and massive gains on the vault’s underlying GM pool.

- A considerable and prolonged price increase of the volatile asset.

- Smart contract risks for Steadefi and/or GMX.