Thesis

This vault is suitable for depositors who want to earn passive, market neutral, no impermanent loss, leveraged yields in USDC from trader and funding fees in Aark Digital perpetual exchange’s AALP liquidity pool.

With a special partnership arrange between Steadefi and Aark Digital, this vault has the lowest fees to depositing Aark (0.04% per entry/exit) while having the highest leverage (3x).

Essentially, this vault is best if you:

→ Want to earn passive and leveraged yields in a market-neutral manner over a period of time

→ Believe Aark Digital continues to generate great funding fees from their perpetual exchange

→ Believe that AALP will continue to hold it’s value and grow (steadily) over time

Overview

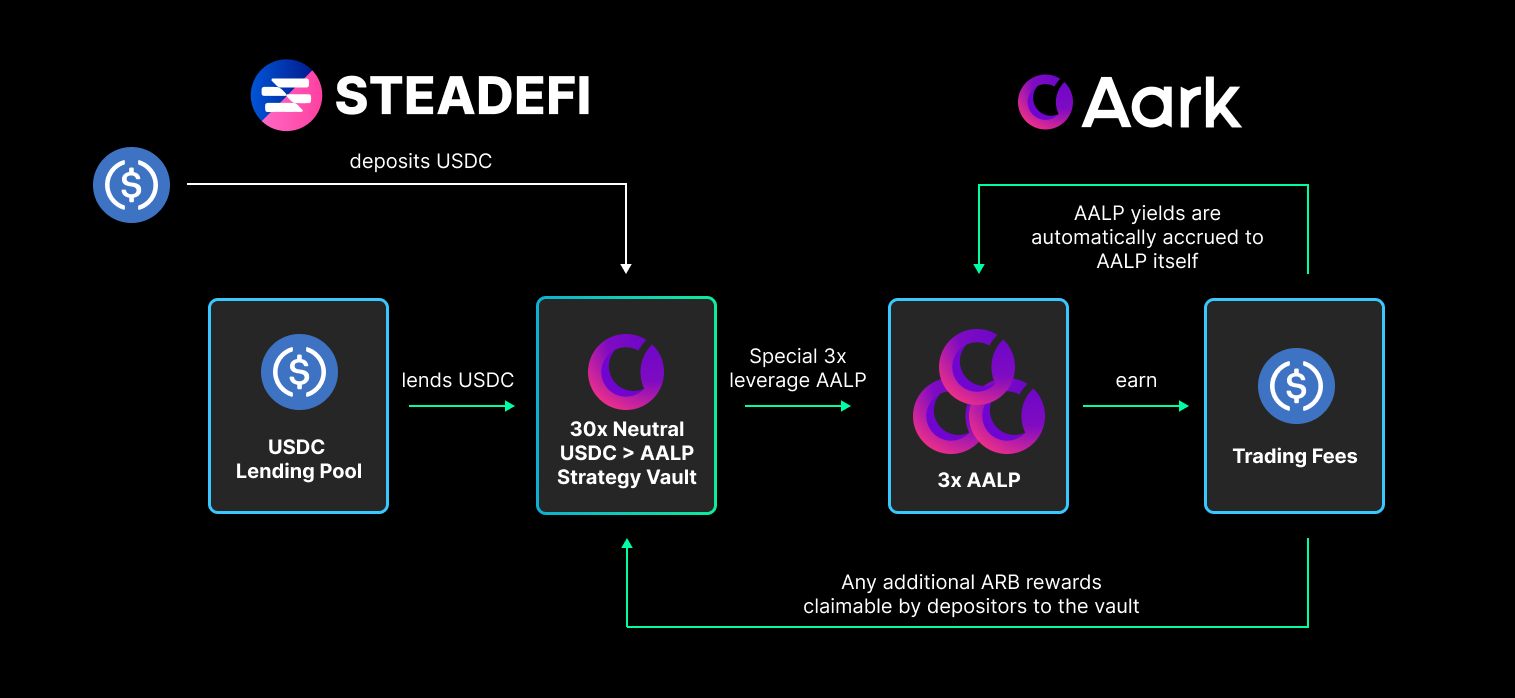

Using 30x leverage on deposits by borrowing 9x of your deposits from Steadefi lending vaults and leveraging 3x of AALP on collateral on Aark, this strategy earns more yield from Aark Digital’s AALP via funding fees, while having no exposure to impermanent loss and being market neutral.

Chains

Arbitrum

Implementation

- Depositor deposits USDC to the vault and receives svTokens

30N-USDC|AALP-AARK(note that Aark charges 0.04% on TOTAL deposited value on entry)

- Vault borrows USDC so that the total value of assets are now 30x the value initially deposited

- Vault deposits all assets to Aark as collateral

- Vault orders 3x the value of collateral worth of AALP

- Keeper compounds any additional rewards given to the vault

- Keepers check vault’s position status to determine if a rebalance is needed

- Depositor withdraws their position from the vault by burning svTokens

30N-USDC|AALP-AARKand receives USDC tokens (note that Aark charges 0.04% on TOTAL deposited value on entry)

Rebalance: a “reset” of the vault’s assets such that the debt ratio stays within a healthy range and the delta exposure is true to the intended strategy.

Risks

- NOT ideal for short-term depositors: Aark charges 0.04% per deposit/exit of AALP. With the high amount of leverage, this comes up to ~1.2% on the user’s deposit value into this vault per deposit and withdrawal.

- Aark’s AALP value having sudden drops, resulting in potential liquidations

- Traders on Aark keeps winning against liquidity providers

- Smart contract risks for Steadefi and/or Aark Digital

- Operational security risks for Steadefi and/or Aark Digital