Thesis

This vault is suitable for depositors who want to leverage into LRTs (such as KelpDAO’s rsETH, EtherFi’s weETH and so on) to earn LRT points and/or to get exposure to LRT yields (which relatively speaking to the lending rates on Steadefi, are currently a lot lower) by borrowing non-ETH correlated assets to leverage more into LRTs.

Essentially, this vault is best if you believe:

→ You want to leverage into LRTs to be able to earn more LRT and Eigenlayer points for future rewards 🎁

→ ETH and the various LRTs will continue in an upward trend relative to the non-ETH asset that the vault is borrowing 💹

Overview

Using 3x-5x leverage on deposits, this strategy helps depositors get much higher exposure to LRTs with the capital deposited by borrowing another non-ETH asset to swap for the LRT.

Chains

Arbitrum

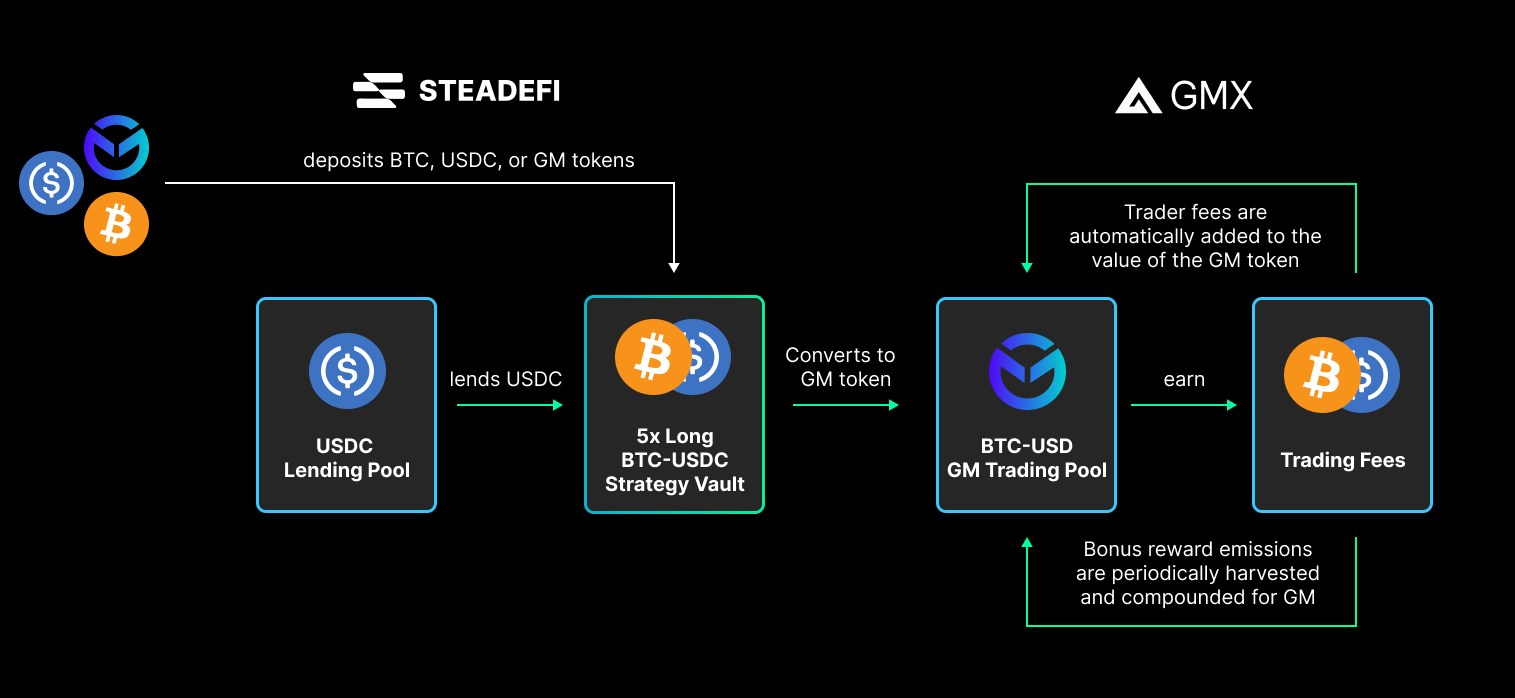

Implementation (3x Long USDC > RSETH Pool example)

- Depositor deposits ETH, WETH, wstETH or rsETH to the vault and receives svTokens ; e.g.

3L-USDC|RSETH-KEP

- Vault borrows USDC (or any other asset that is non-ETH) so that the total value of assets are now 3x-5x the value initially deposited

- Vault converts all assets for the LRT token

- Keeper compounds additional rewards (if any) for more LRT tokens

- Keepers check vault’s position status to determine if a rebalance is needed

- Depositor withdraws their position from the vault by burning svTokens and receives ETH

Rebalance: a “reset” of the vault’s assets such that the debt ratio stays within a healthy range. In uptrending markets, this means the vault will increase leverage over time, and in downtrending markets, the vault will decrease leverage over time.

Risks

- LRT and Eigenlayer points and rewards are not as impactful as desired

- Price of the borrowed asset relative to ETH and the LRT increases, resulting in value decreases

- Price of ETH and the LRT drops, resulting in value decreases

- Borrowing costs gets too high due to high utilization rate

- Smart contract risks for Steadefi and/or the LRT itself