Steadefi has two main types of vaults: Lending Vaults and Strategy Vaults.

Strategy Vaults borrow assets from dedicated Lending Vaults to carry out their determined yield strategy, which usually involves leverage and hedging of volatile assets while deploying liquidity to protocols that generate yield.

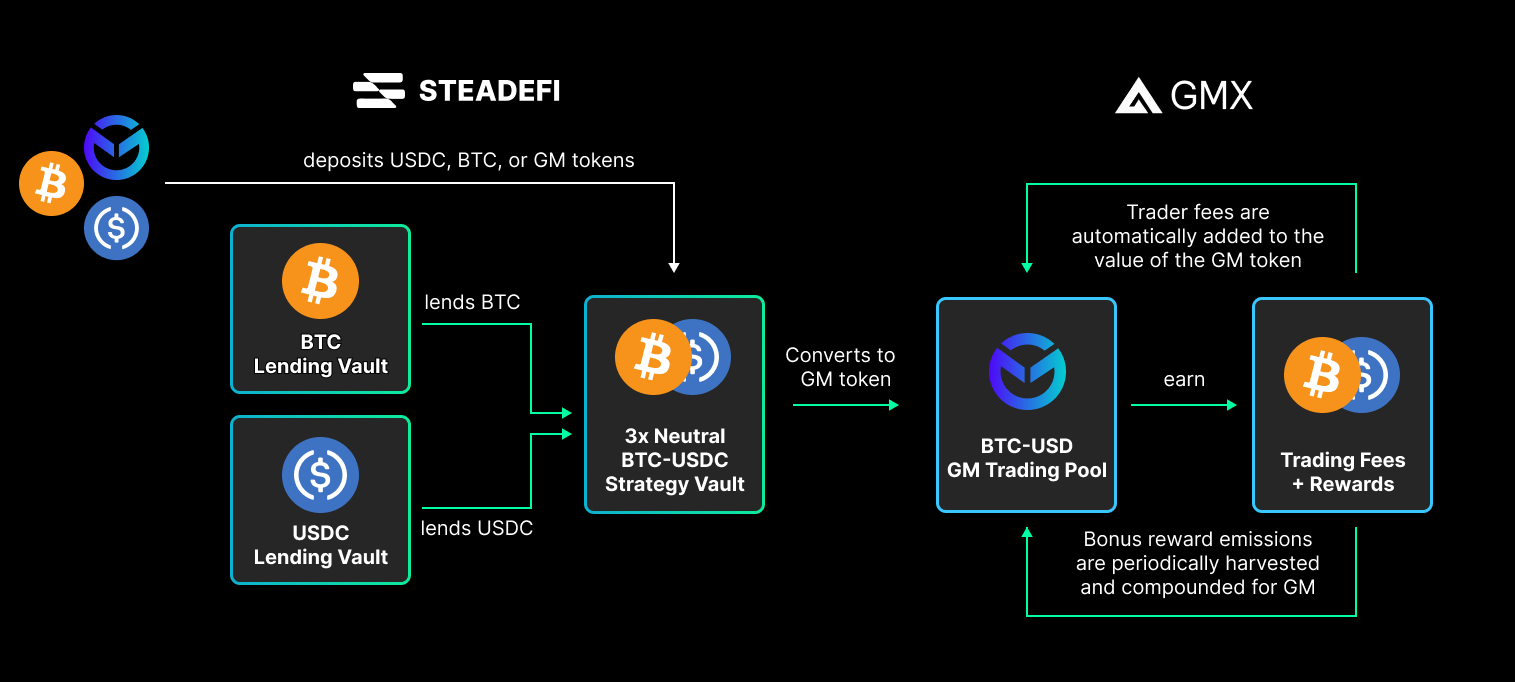

The diagram below shows an example of how several Lending Vaults provide assets (WBTC and USDC in this example) to a Delta Neutral Strategy Vault, which borrows the assets for leverage and hedging while deploying them to GMX to earn yield.

Lenders provide assets to isolated Lending Vaults in exchange for lower, but safer and more stable yield returns and profits.

Depositors deposit assets to their preferred Strategy Vaults in exchange for riskier, but leveraged yields that may or may not be ultimately profitable depending on the strategy and market movements. Every strategy vault is monitored and managed by automated keepers that checks if the strategy vault require rebalancing based on the vaults’ health parameters, such as its’ debt ratio or asset delta.