Thesis

This vault is suitable for depositors who want to earn yield in BTC, ETH, ARB, or AVAX from fees in the GMX GM trading pools, while believing that the price of these assets will trend sideways or downwards with high market volume.

Essentially, this vault is best if you believe:

→ BTC, ETH, ARB, or AVAX will continue in a sideways trend. ↔️

→ Your selected GMX v2 pools will continue to attract traders for earning fees. 🧲

→ The perp traders on your selected pools will continue to lose more than they gain. 🕗

Overview

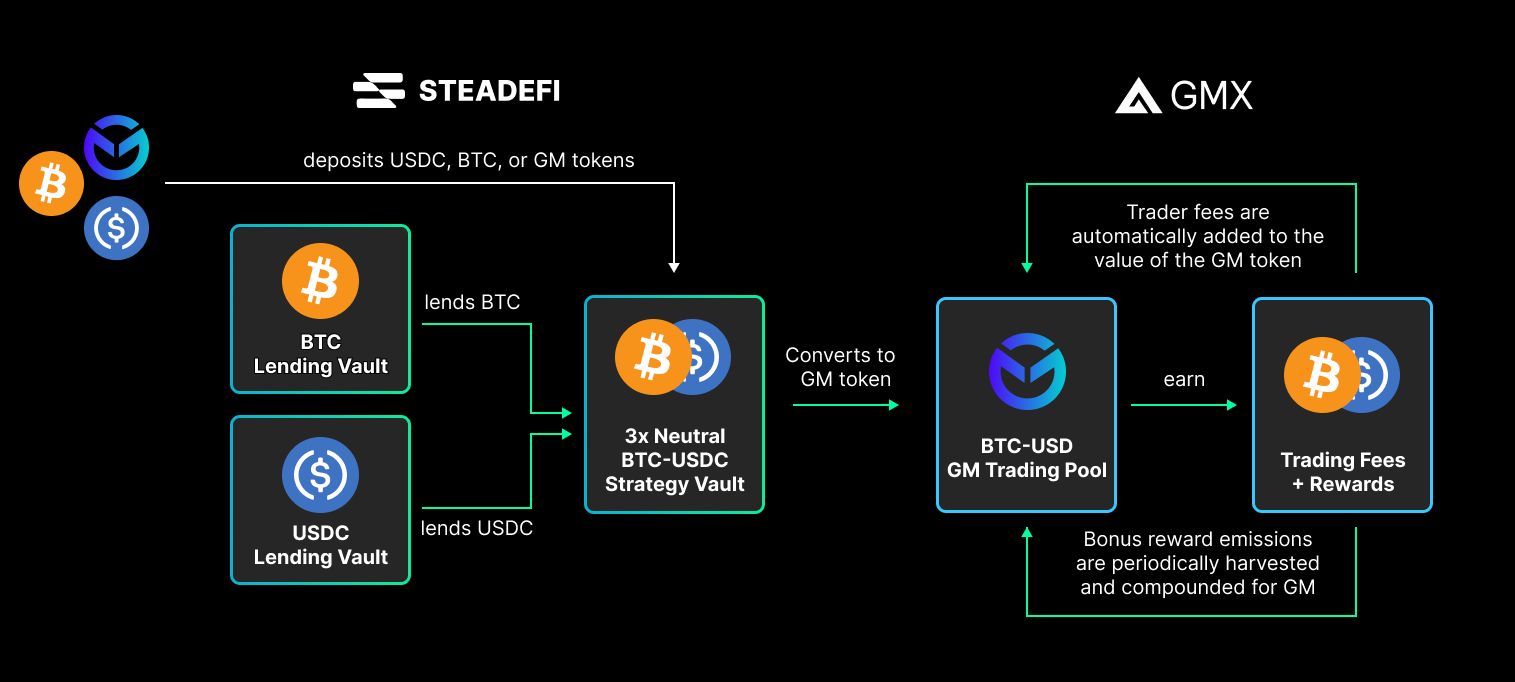

Using 3x leverage on deposits, this strategy earns more yield from the GM pool trading fees, while also limiting exposure to the price of the volatile asset.

Chains

Arbitrum

Implementation (BTC-USDC GM Pool example)

- Depositor deposits BTC, USDC, or GM token to the vault and receives svTokens

3N-BTCUSDC-GMX

- Vault borrows BTC so that the total value of assets are now 3x the value initially deposited

- Vault swaps the optimal amount of BTC to USDC to create a market-neutral position

- Vault deposits all assets to mint GM tokens

- Keeper compounds additional rewards (if any) for more GM token

- Keepers check vault’s position status to determine if a rebalance is needed

- Depositor withdraws their position from the vault by burning svTokens

3N-BTCUSDC-GMXand receives USDC or GM tokens.

Rebalance: a “reset” of the vault’s assets such that the debt ratio stays within a healthy range and the delta exposure is true to the intended strategy.

Risks

- GMX traders make consistent and massive gains on the vault’s underlying GM pool.

- Significant and sustained market volatility which causes frequent rebalances.

- Smart contract risks for Steadefi and/or GMX.