Thesis

This vault is suitable for depositors who want to leverage into LRTs (such as KelpDAO’s rsETH, EtherFi’s weETH and so on) to earn LRT points and/or to get exposure to LRT yields (which relatively speaking to the lending rates on Steadefi, are currently a lot lower) while staying delta-neutral to ETH, as the strategy borrows ETH to leverage into LRTs.

Essentially, this vault is best if you believe:

→ You want to leverage into LRTs to be able to earn more LRT and Eigenlayer points for future rewards 🎁

→ ETH and the various LRTs will continue in an upward trend 💹

Overview

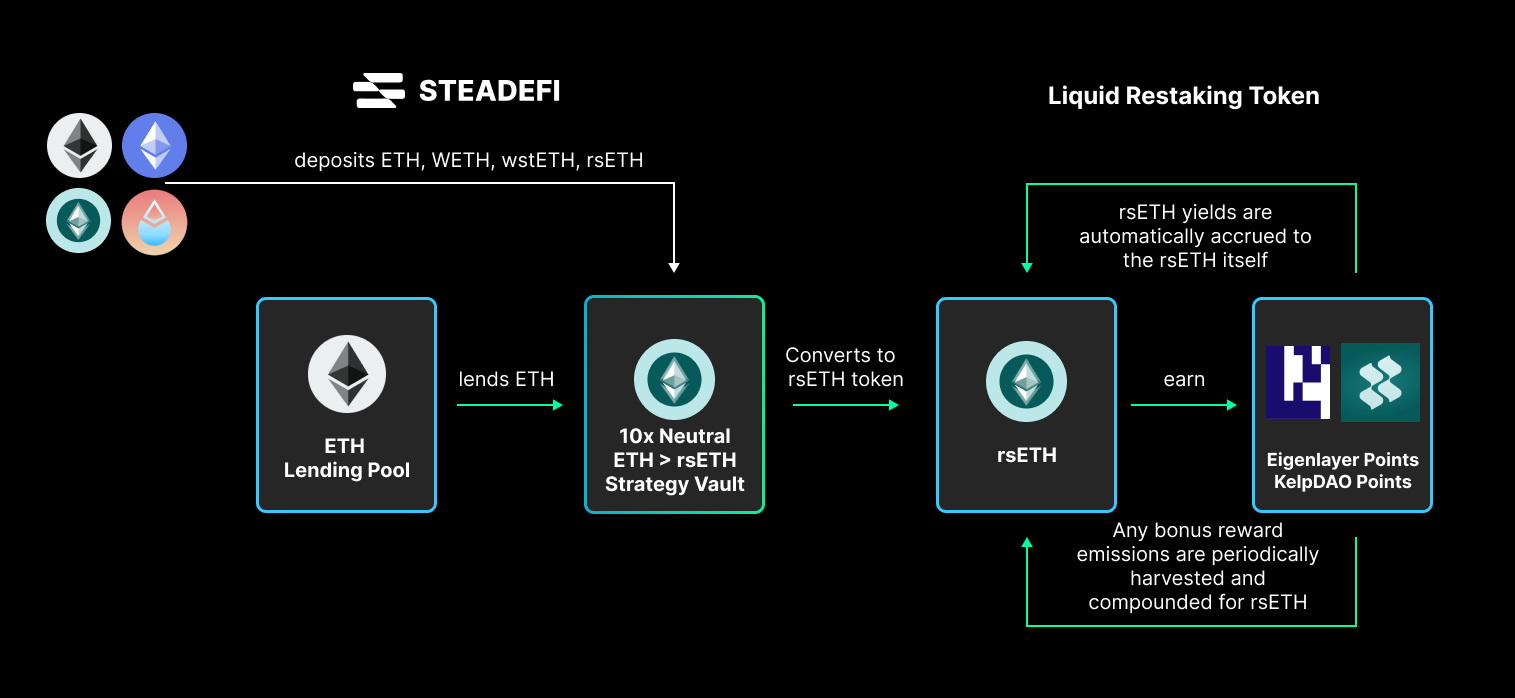

Using 10x leverage on deposits, this strategy helps depositors get much higher exposure to LRTs with the capital deposited by borrowing ETH to swap for the LRT.

Chains

Arbitrum

Implementation (10x Long ETH > RSETH Pool example)

- Depositor deposits ETH, WETH, wstETH or rsETH to the vault and receives svTokens ; e.g.

10L-ETH|RSETH-KEP

- Vault borrows ETH so that the total value of assets are now 10x the value initially deposited

- Vault converts all ETH for the LRT token

- Keeper compounds additional rewards (if any) for more LRT tokens

- Keepers check vault’s position status to determine if a rebalance is needed

- Depositor withdraws their position from the vault by burning svTokens and receives ETH

Rebalance: a “reset” of the vault’s assets such that the debt ratio stays within a healthy range. In uptrending markets, this means the vault will increase leverage over time, and in downtrending markets, the vault will decrease leverage over time.

Risks

- LRT and Eigenlayer points and rewards are not as impactful as desired

- Price of the borrowed asset relative to ETH and the LRT increases, resulting in value decreases

- Price of ETH and the LRT drops, resulting in value decreases

- Borrowing costs gets too high due to high utilization rate

- The price of the LRT depegs with ETH; getting lower than it should be

- Smart contract risks for Steadefi and/or the LRT itself