Steadefi’s lending vaults are single-asset vaults that earn fees by charging interest to borrowers, which will only be Steadefi’s strategy vaults.

Each lending vault is isolated to a specific group of strategy vaults — typically catering to a specific yield source (e.g. ETH-USDC GM pool) in a specific protocol (e.g. GMX), which isolates risks in case of any exploits in a particular yield source or protocol.

Lending vaults fit the more cautious risk/reward user profile, as well as a “maximalist” in a particular asset.

Protocol Fees

A 20% fee is charged on interest earned to lenders.

Profit Sharing Rates

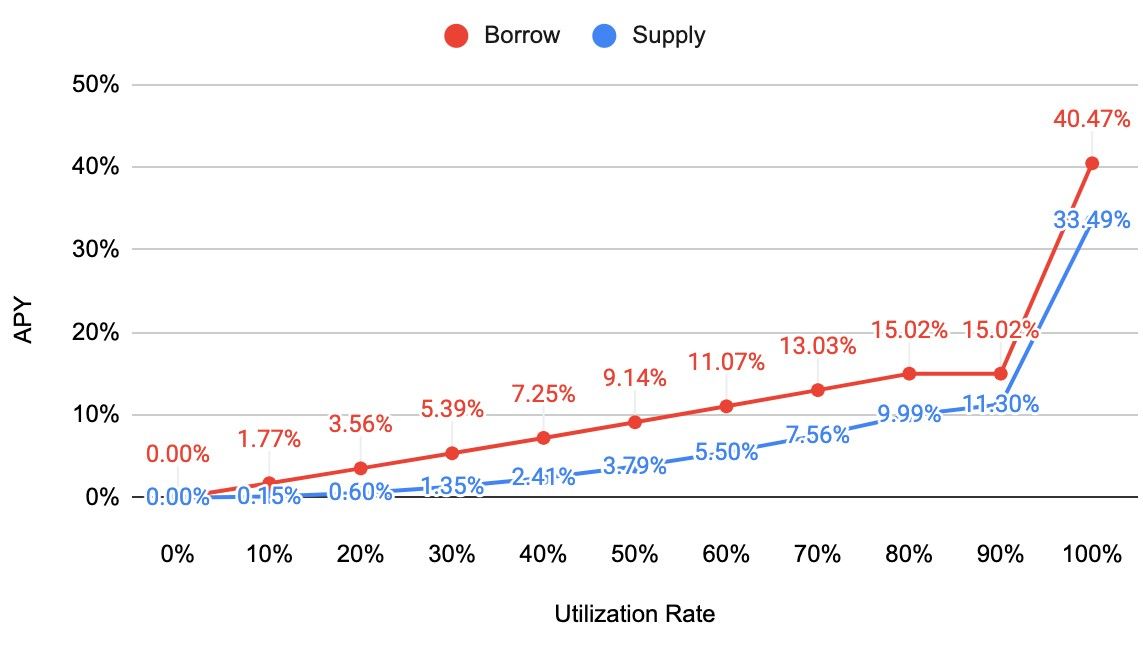

Existing interest rate models for lending vaults and protocols rely only on utilization rate as a means to determine borrow/lending rates. We believe this is not the most ideal model.

For borrowers, the largest concern with the “utilization rate” system is the potential negative APRs on their position. In this case, the borrowing rates would be higher than their yields, effectively putting them in a losing position until more lending funds are deposited or borrowers reduce their position. Even with our vault’s debt-ratio rebalancing borrowers may still be at a disadvantage due to low yields and high utilization rates.

For lenders, the returns they receive are limited by a linear model that is based entirely on the “utilization rate”. This means that lenders make significant yields on their deposits when borrowing is high, and likewise they earn very little yield when borrowing is low.

In this model, there are three issues:

- lenders have no means to profit when borrowers are making higher yields

- lenders earn low interest when utilization is low

- when utilization is high, it may attract more lending supply, which quickly diminishes early lenders’ returns

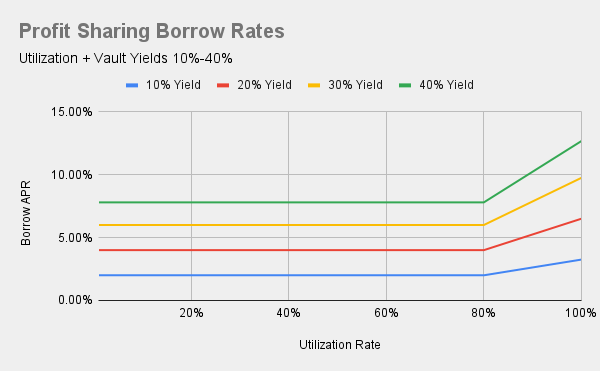

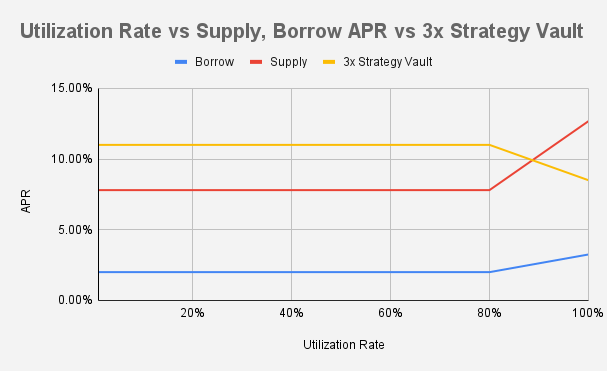

Our Profit Sharing Rate Model aims to address these issues by:

- providing a fixed borrowing rate for strategy vaults

- sharing yields with lending vaults

For depositors in strategy vaults, they will not have to worry about negative yields/APRs. Instead of relying on low utilization rates to maintain the health of their positions, borrowers’ rates will depend purely on their underlying yield by sharing a small percentage of their profits with lenders.

For lenders in lending vaults, they have more exposure to the upside of yields as they receive a tightly controlled portion of the borrowers’ profits. Lending APRs will now rely on three variables: yield amount from the borrowing vault’s underlying protocol, percentage of the profit share from the connected vaults, and the pool’s utilization rate.

Addressing some of the current problems with lending - borrowing “utilization rates”, this profit sharing model is a solution to prevent negative APRs on a vault, while allowing lenders to share in the profits.